Fuente: PwC Governance Insights Center

Autores: Maria Castañón Moats, Leah Malone & Chris Hamilton

Revisa acá el archivo completo en formato PDF

Purpose driven leadership: the evolving role of ESG metrics in executive compensation plans

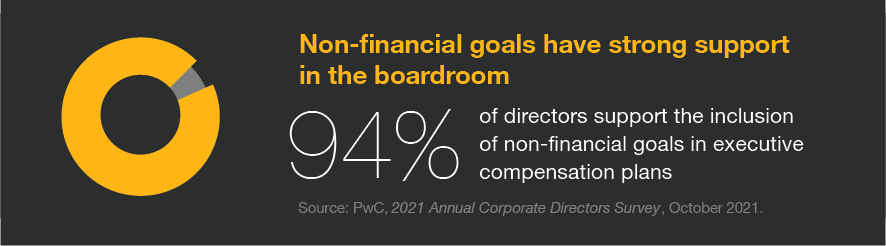

Environmental, social, and governance (ESG) issues are undeniably making their way onto corporate boardroom agendas today. Many large institutional shareholders are asking companies to focus more, do more, and disclose more about ESG efforts.

ESG metrics: The roadmap to readiness

Thinking through implementation

- Which metrics and weighting?

- To whom should the goals apply?

- How do the metrics operate?

- What time horizon is appropriate?

- How will this affect disclosure?

Which metrics and weighting?

Some companies are using a dozen or more different types of ESG metrics in their compensation plans. Which metrics are right for the company’s executive team will depend on a number of factors. Currently, the most common types of metrics relate to human capital management and social issues. Among the S&P 500 companies that use ESG metrics, 41% use some kind of human capital-related metric, with diversity and inclusion (D&I) metrics being most common. Only 14% are using one or more environmental-based metric.

What could go wrong?

For boards and compensation committees thinking about adding new metrics to compensation plans, it’s important to consider the risks associated with those changes.